Earn rewards for learning

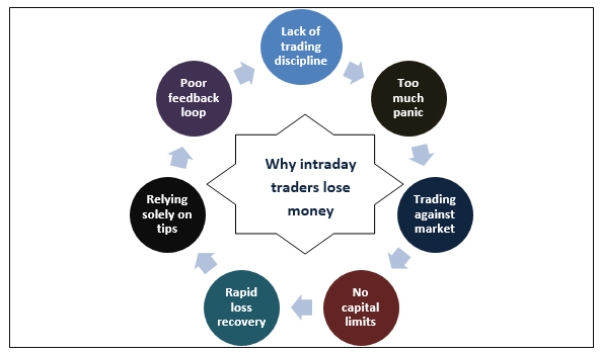

Regardless of the type of candle or implication, the point is that every candle has a story to tell. Trading accounts are commonly used by day traders to buy and sell securities, and so tend to experience high transaction volumes. Covered CallA covered call is a situation in which an investor sells a call option while owning the underlying stock, generating income the premium for the investor with the risk of potentially losing the upside appreciation of the shares if the option is exercised and the investor must sell their shares. It referred to the process of preparing. Financial settlement periods used to be much longer. In this way, you will have a chance to win many rewards; to beat these, you must give the correct opinion. There are examples of this near the top of the page on the examples twitter posts. As above, the value of the option is estimated using a variety of quantitative techniques, all based on the principle of risk neutral pricing and using stochastic calculus in their solution. In the world of online trading, finding the most trusted. The same is true about the trading industry. The term trading strategy can in brief be used by any fixed plan of trading a financial instrument, but the general use of the term is within computer assisted trading, where a trading strategy is implemented as computer program for automated trading. After a strong trend, price gaps higher but fails to keep on going higher. However, there are some charting types that appeal to me much more both visually and logically, than time based charts.

How margin trading works

Share India group of companies is just acting as distributor/agent of Insurance, Mutual Funds and IPOs. Among third party tools that I found useful is AutoChartist which provides automated technical analysis ideas. Staking or rewards program: None. Webull is best for beginners interested in hand picking commission free stocks, ETFs, and options. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Use profiles to select personalised content. We’ve looked at some of the most popular top level strategies, which include. Range/swing trading: This strategy uses preset support and resistance levels in prices to determine the trader’s buy and sell decisions. You can indeed practice trading using Plus500’s free and unlimited demo account. However, because earnings are so important, the stock may falter and reverse as in the case here, resulting in a losing trade. During this phase, manipulation of prices is achieved that creates sufficient liquidity for resuming the preceding trend. Clients are limited to spot forex trades. Gonna invest in VOO and I want to https://pocketoption-trading.ink/ know what platform is easy to use for a beginner. Although both swing trading and day trading aim to achieve short term profits, they can differ significantly when it comes to trading duration, trading frequency, size of returns per profit target, and even the style of market analysis. Develop and improve services. Moving Average Crossover Strategy. To talk about opening a trading account. Some brokers also allow you to purchase fractional shares, which means you can buy a portion of a share if you can’t afford the full share price. Understand audiences through statistics or combinations of data from different sources. 5 times, it is great for traders who want to practice without jumping into real money market and making unnecessary losses. You may be forced to sell at less than the market price or buy at more than the market price. For example, an employee with continuous access to inside information can pass it on to acquaintances with instructions to trade specific stocks related to that information to earn risk free money from that trading.

Different Types of Crypto Exchanges

And while I like that they include news, earnings, and jobs reports, it’s more info than I, as a pretty passive trader, usually need. When the ADX indicator is below 20, the trend is considered to be weak or non trending. Read more and be a successful Investor. For a $100,000 trade, a pip usually equals $10. Together, investors set the value of the company by what price they’re willing to buy and sell at. 01 in most stocks today. Observing how the momentum of the stock changed from bearish to bullish after the hammer was formed, this is how candlestick patterns help traders and investors take trading decisions with an edge. This is fundamental to align with the volatile nature of options trading. Since the securities collateralize your loan, any price declines reduce your equity and potentially trigger a margin call. These types of traders tend to close their positions as soon as the price moves above or below the breakeven, depending on the position they took, happy with taking a small percentage of profits after the spread has been covered. All information is collected directly from the companies, their websites or a firm representative. Receive a notification whenever a Buy or Sell Technical Analysis Signal appears for the chosen coin. This could be a reversal of a downtrend or a continuation in an uptrend. Com operates through the following subsidiaries. Lo, Harry Mamaysky, and Jiang Wang, published in The Journal of Finance, the success rate attributed of three inside up pattern was approximately 64% in predicting bullish reversals. Gov means it’s official. “Margin Rules for Day Trading. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. HDFC Securities offers a secure trading platform with extensive research reports and seamless integration with HDFC Bank. While the concept of intraday trading generally considers buying and selling assets the same day, these indicators can be used to maximize profit as well as have a better overview and understanding of the financial market. With IG Premium Client ManagerBianca Fischer.

Upstox Vs Groww: Stock Broker Comparison

You buy stocks worth Rs. Besides, the perfect app should offer useful features, be compatible with both iOS and Android systems, as well as have an appealing design. Here is what to watch out for. In Case you missed it. Delta neutral is a portfolio strategy consisting of multiple positions with offsetting positive and negative deltas—a ratio comparing the change in the price of an asset, usually a marketable security, to the corresponding change in the price of its derivative—so that the overall delta of the assets in question totals zero. Options and futures are two varieties of financial derivatives investors can use to speculate on market price changes or to hedge risk. Fortunately, we offer mechanisms to help you manage your risk. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. We use cookies to personalize content provided by analytic and advertisement partners to offer you the best service experience. For many classes of options, traditional valuation techniques are intractable because of the complexity of the instrument. Best In Class for Offering of Investments. Traders like scalp traders often use 5 minute charts. Get started with a live account today and explore the many trading strategies that can be applied to the stock market. Stop Loss Rules: Implement rules to exit positions if losses exceed predefined thresholds. Testimonials might be fake or come from subscribers who happened to get lucky enough to actually make money. The xStation 5 platform is user friendly, packed with advanced charting tools, and supports a wide range of technical indicators. Professional clients trading spread bets and CFDs can lose more than they deposit. Com has all data verified by industry participants, it can vary from time to time. “Options: The Plain and Simple Guide to Successful Strategies” by Lenny Jordon Financial Times Guides was an excellent read and kept by me for constant referencing. Traditional full service brokers do more than assist with the buying and selling of stocks or bonds. These expenses support the overall functioning of your business. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Instead of simply running a back spread with calls sell one call, buy two calls, selling the extra call at strike D helps to reduce the overall cost to establish the trade. City Index mobile, MetaTrader mobile. Analyzing Stock Volatility. With Appreciate you can easily invest in US equities, fixed deposits, ETFs, bonds, digital gold, savings accounts and many more lucrative investment products at a very low cost to diversify your portfolio and enjoy higher returns. Your trading style will dictate your daily routine, the time you dedicate to trading, and the level of stress you experience. A good starting place for beginners is to study the three types of active trading: intraday trading, day trading, and swing trading. In its most basic terms, the value of an option is commonly decomposed into two parts. Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange.

Download and install the app

It is the second book written by the late Mark Douglas, who taught investment professionals and individual traders to master their psychology. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. Because position traders look at the market’s long term trajectory, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture potential returns that may result from correctly forecasting the large scale context. Woo I love all the explanation in this sight. Disclaimer: NerdWallet strives to keep its information accurate and up to date. Discover how automated trading works and which software you can use to automate your trading with IG. And many have protections against unauthorized trading activity, so you’re protected if your account gets hacked. Legendary traders like Paul Tudor Jones highlight the importance of protecting capital to achieve trading success. An investment app is a service for mobile devices that allows users to invest and manage their money in various financial markets, including stocks, bonds, mutual funds and cryptocurrencies. Below is a list of some of the advantages of scalping. CFD traders will also have to pay a commission charge in addition to the spread when trading shares. 5 to test trading on the go. For example, if you live in the U. Speciality Has many advanced trade analysis tools. Some traders prefer to see the thickness of the real bodies, while others prefer the clean look of bar charts. In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. This cost is expressed as a percentage and taken out from the amount you’ve invested, which lowers the amount of returns you receive. A protective put is also known as a married put.

Pros

To set up a managed account, you must do so through Schwab. I could do transaction from my APS account too, which one do you suggest. INH000000164, InvestmentAdviser SEBI Regn. Download Sharekhan App. One key aspect is setting stop loss orders, which automatically exit a position if the price moves against you by a predetermined amount. Following are the stock market holidays 2024 trading holidays for the current year for the Commodity Derivatives Segment. Webull offers $0 commission trading, even on options, where it doesn’t charge a per contract fee. What is margin trading. We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. You can use position trading as a means for preparing for your future.

Top 6 Investment Trends In India For 2024

The industry’s best pricing. When creating a trading strategy, an investor works alongside a broker dealer to choose profitable trading products and manage trading activities. These risks include, but are not limited to, lower liquidity, higher volatility and wider spreads. Investopedia / Julie Bang. BSE and National Stock Exchange of India Ltd. The Bearish Engulfing pattern consists of two candles: the first is a smaller bullish candle, and the second is a larger bearish candle that completely engulfs the body of the first candle. Symmetrical Triangle Pattern. New traders who prefer a longstanding, legacy brokerage should consider Charles Schwab.

:max_bytes(150000):strip_icc()/GettyImages-490556036-1f443237f9864342b101cd301a12aeec.jpg)

Sister Websites

Take Control and Invest Directly. Understanding the regulatory environment around day trading is crucial. That being the case, it may be that you just want to find a very simple investment app to use for trade execution and use external tools for the investment decision making process. The three inside down pattern indicates a potential shift in market sentiment from bullish to bearish. Do you have an email I can send your a message. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. If USD/JPY rises to 121, Trader A will lose 100 pips on this trade, which is equivalent to a loss of US$4,150. There are many strange and bizarre stories he tells from 1984 through the crash of October 1987. EToro is a multi asset investment platform. Senior Trader and CFO. Limited to certain jurisdictions. Volume typically declines within the pattern as the trading range tightens. Using the format, you can understand sales in detail. Simply, Dabba trading is similar to gambling centred around stock price movements. Power ETRADE hits the sweet spot for beginning to intermediate traders. I’m from Nepal and totally new in cryptocurrency world. NET – or any other programming language that supports HTTP. We will begin with the platform that we like they most, namely, TradeStation. With the guidance provided in this article, you’re now equipped to download, install, and start your journey into the colorful world of digital asset trading. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. If a stock is consistently reaching higher lows, it is in a clear uptrend. Automated investing through Schwab Intelligent Portfolios® requires a minimum $5,000 deposit. Thereafter, all that remains to be done is to create a trading plan and open a live account. The most common reason for failed trades is the lack of knowledge about trading. 25 and you decide to close your position at $1,820, you’d make gains of $500 10 points x $50 as the market would’ve moved in your favour by 10 points excluding any additional costs. However, beginner traders may find the Exness web terminal and trading app much easier to get started with. Scalping was originally referred to as spread trading.

Track Market Movers Instantly

Candlestick charts are important for trading because they convey more information than traditional bar or line charts. These are DI+ and DI. Once you start investing, keep hold of long term investments—that’ll give you the best chance of getting the most stable and profitable returns. You can also sell put options. I think it would be hilarious if we could add our own alert sounds and notifications, i. Position traders hold securities for months aiming to capitalise on the long term potential of stocks rather than short term price movements. Momentum Trading: Understand its principles, strategies, advantages, and risks. Therefore, you can pick this style only if you have the wherewithal to support it. Leverage is often compared to a double edged sword because if the market moves against a trader’s position, the incurred losses can quickly surpass the investment, sometimes necessitating additional deposits from the trader to cover the deficit. You can simply fulfil a variety of accounting needs through one Vyapar app. Understand audiences through statistics or combinations of data from different sources. Blain created the original scoring rubric for StockBrokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Market authorities determine trading schedules and hours for different commodities. To determine the best approach for your specific investment goals, speaking with a reputable fiduciary investment advisor is recommended. These strategies include the following. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. Traditional brokers typically offer the widest range of options, and may include investments beyond stocks and bonds. Com uses a variety of computing devices to evaluate trading platforms. If there’s a rise in the spot gold price that increases its value to $1,820. If you follow these simple guidelines, you may be headed for a sustainable career in day trading. Trading on margin means borrowing your investment funds from a brokerage firm. We offer our research services to clients as well as our prospects. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us.

Quick Links

Many new traders look for the one perfect strategy, and do not realize that they need several strategies in different markets to be able to get those returns that they dream of. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. Read more about put options. Whenever you hit this point, exit your trade and take the rest of the day off. We care about fairness and transparency so you always know how much you’re paying when you trade with us. Before sharing sensitive information, make sure you’re on a federal government site. Traders who implement this strategy place anywhere from 10 to a few hundred trades in a single day with the belief that small moves in stock prices are easier to catch than large ones. Please keep me updated on Trade Nation’s sponsorships, news, events and offers. “Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques. One good way to manage the risk of overtrading is to simply be self aware. Knowing how to read and analyze these common candlestick patterns helps you make informed trading decisions and minimize risks. If the complaint does not get redressed within 30 days, the complainant may use SCORES to submit the grievance. The cryptocurrency market is gaining popularity, in addition to the well known Bitcoin, and there is a wide variety of other virtual currencies. It is always worth remembering that to make a profit, you must reduce your costs. Exercising means utilizing the right to buy or sell the underlying security. It shows momentum shifts that are often visible before market volume peaks, making it an influential indicator for swing traders. Let’s get to know the commodity market timing in India and also what factors tend to impact these timings. 2 Tax laws are subject to change and depend on individual circumstances. One way to think of a country’s currency is similar to the way equity investors think of stocks. It offers a crypto exchange with trading in 27 cryptocurrencies, as well as an online brokerage platform with access to a limited selection of stocks and exchange traded funds ETFs. Use limited data to select content. Shubham Sharma 22 Mar 2023. Scalpers can also take advantage of the bid ask spread to profit. The traders should open a long position near the support area and place a stop loss order below the lower low when the Double Bottom Pattern starts to form. INR 0 on equity delivery.

Education

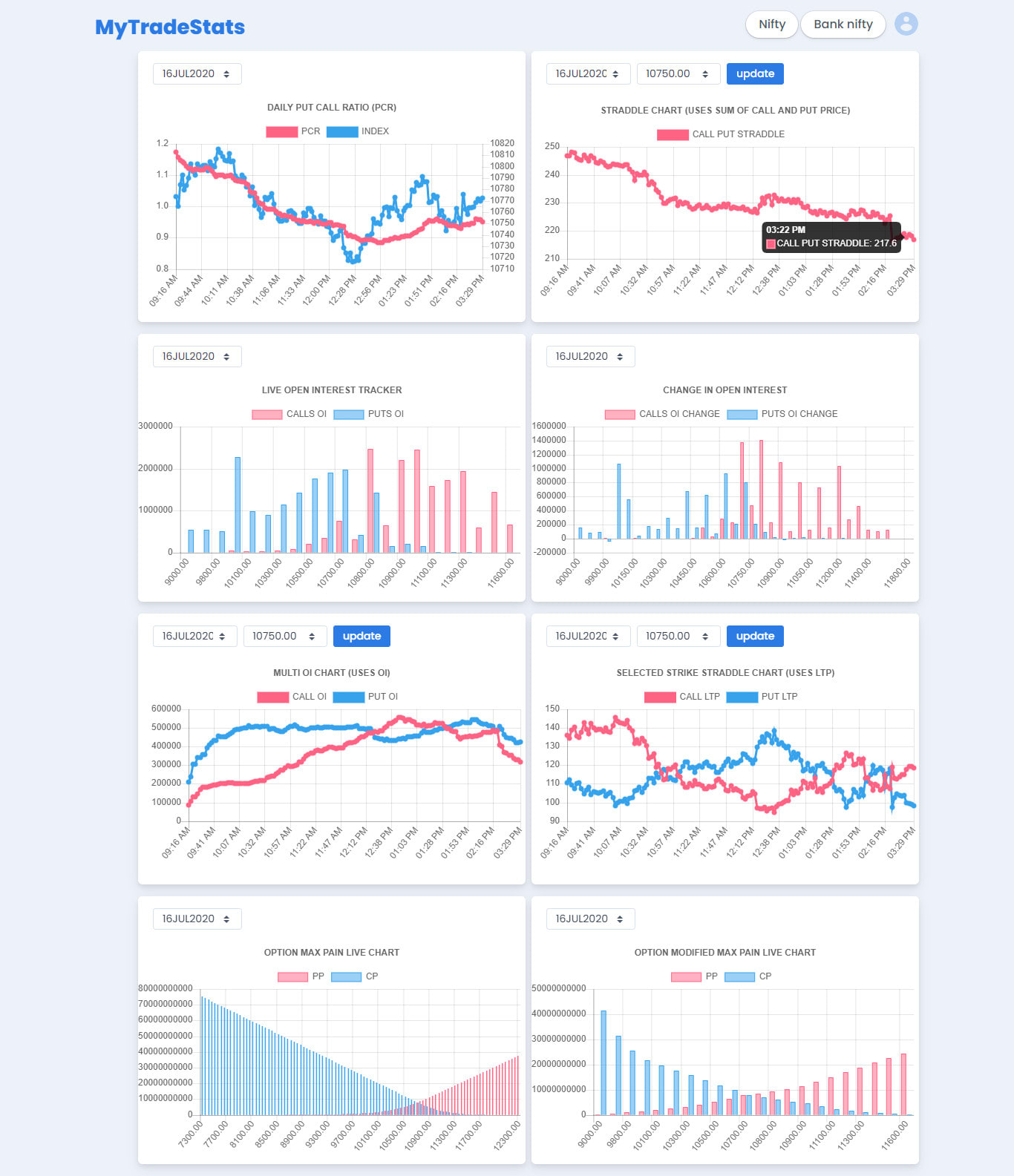

On Robinhood’s website. After having poured over the technical indicators, its time we traverse to Order and Trade book data. FREE Account OpeningFlat ₹20 Per Trade. Conversely, if the market is bullish, they may short sell stocks, expecting a shift in sentiment. Volatility is an implicit characteristic of the share market. Our commitment is to deliver optimal value for money trading solutions, leveraging the latest in cutting edge technology. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. The first and foremost is the magnified losses. Pros of trend trading. Think about that for a moment. Provides you compelete view of trades placed in your Trading Account.

Follow us on

I opened accounts and entered trades at 17 online brokers and chose the top five that I recommend the most for beginners. This site does not include all companies or products available within the market. Spot Trading: Explore advanced settings for Limit Order and set Take Profit/Stop Loss TP/SL levels simultaneously when placing an order. Discover everything you need to know about multilateral trading facilities MTFs including what they are and how they work, as well as the differences between MTFs, regulated markets RMs and organised trading facilities OTFs. Collect Bits, boost your Degree and gain actual rewards. Margin is a key aspect of trading. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. To see an intuitive, comprehensive directory of highly regarded regulatory agencies, check out our Trust Score page. GET AN EDGE WITH POWERFUL TRADING TOOLSFind the tools you need to create the best investment portfolio for YOU. In addition to using different order types, traders can specify other conditions that affect an order’s time in effect, volume, or price constraints. Technical analysis is the reading of market sentiment via the use of graph patterns and signals. The seasoned trader will know that it’s a matter of placing a large enough sample set of trades for things to net out. A covered call involves selling a call option “going short” but with a twist. On the other hand, options trading can be much riskier than buying individual stocks, ETFs or bonds. Trading based on the news is one popular technique. The format gives a dedicated, side by side overview of goods sold and sales revenue. In some cases, one can take the mathematical model and using analytical methods, develop closed form solutions such as the Black–Scholes model and the Black model. The NSE uses the benchmark index, known as “NIFTY 50”, to track how the stock market is performing. Sharpen your trading skills risk free with the paperMoney® platform. Intraday trading promises high returns and thus may sound very attractive. Usually the market price of the target company is less than the price offered by the acquiring company. This transformation has made it easier for both beginner and experienced traders to explore different types of stock trading strategies and execute them efficiently.